100% Of Starbucks ‘Odyssey’ NFT Minters Are in Profit

TL;DR

Starbucks has made a measly $172.5k in royalties from its ‘Odyssey’ NFTs, but all holders that bought their NFTs at mint are currently in profit (across the board).

But if Starbucks can convert more of its 100M customers, it can start making good money from royalties. Converting 10-40% of customer base = $82.14M to 328.57M p/y.

All off the back of a rewards program that also increases the company’s food and beverage sales.

Full Story

If the phrase "let's dig into the down n' dirty numbers" doesn't make you weak at the knees, keep scrolling.

To those of you that are still here: welcome, nerds.

Today we're digging into the numbers behind Starbucks' "Odyssey" NFT rewards program, to figure out:

How much the company has made from secondary sales

How much holders have made from mints

How much room is left to grow

How much has Starbucks made from secondary sales of Odyssey NFTs?

Before we get into it, if you're wondering why we're only looking at royalties earned from secondary sales - it's because some of the of the Odyssey mints (mint = initial release) were paid, while others were given away free.

(Which means we can't get a clean revenue number).

Total NFT holders: 42,000

Total NFTs released: 211,000

Secondary trading volume: $2.3M

Starbucks' royalty fee on secondary sales: 7.5%

Total revenue from secondary sales: (7.5% of $2.3M =) $172.5k

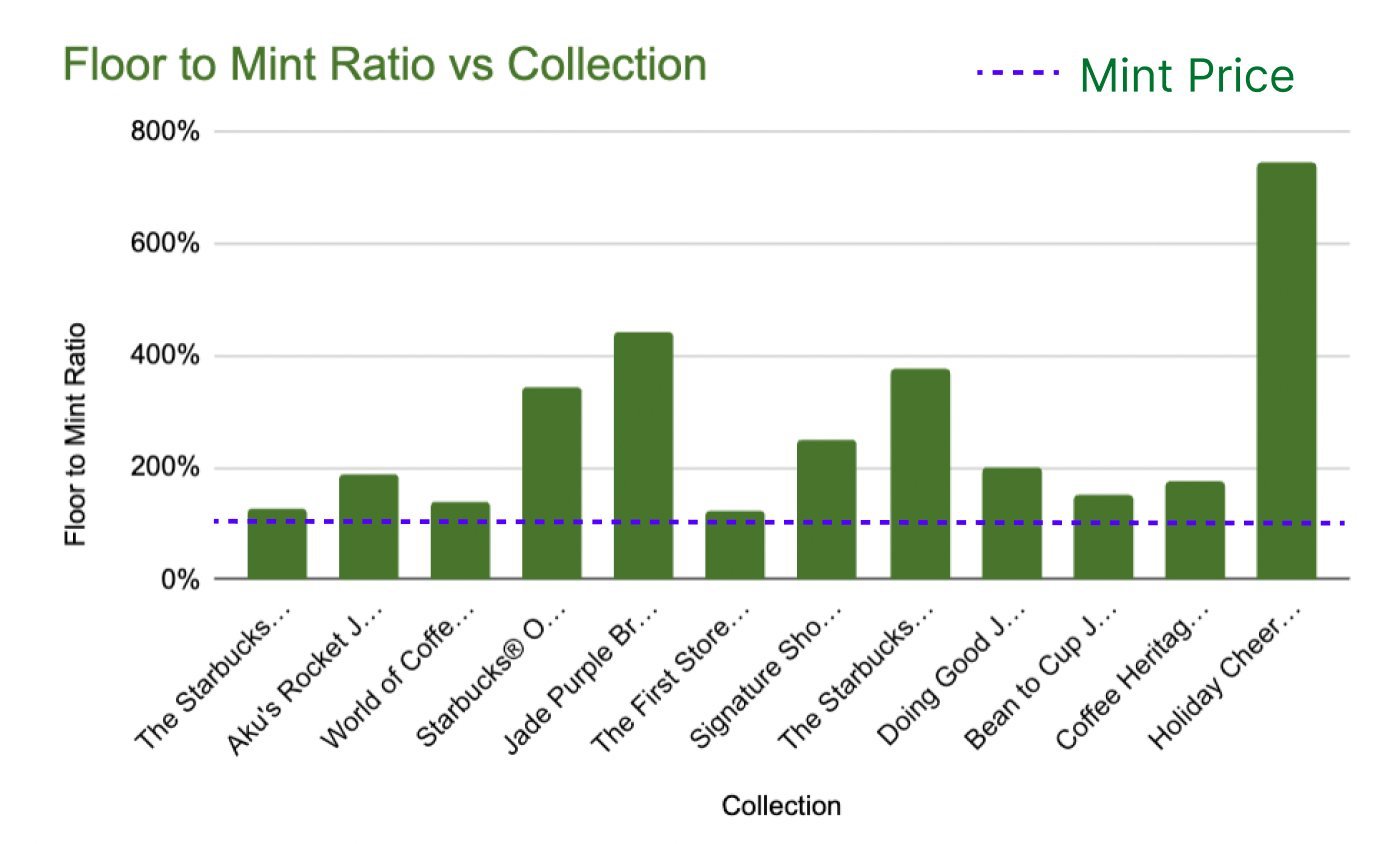

How much have holders made from minting Starbucks Odyssey NFTs?

Anyone of the 42,000 members that minted and held an Odyssey NFT could sell at a profit as of right now.

(Regardless of whether they took part in a paid or free mint - that's awesome to see!)

Which is all well and good for holders - but 211k NFTs sold/gifted to a group of 42k members, all for $172.5k in royalty revenue (made over 7 months) for Starbucks??

That is PEANUTS (less than peanuts) for a $119B company with a customer base of 100M people.

So, how much room is there to grow here?

There's no way Starbucks is going to be able to get all 100M of its customers to join the Odyssey program...but let's pretend it's possible and work our way up from where we're at today.

Right now, 0.042% of Starbucks customers are Odyssey members.

The program has been running for just over half a year and made $172.5k - so let's call that $345k per year.

Now, let's see what happens as we start to bump the member number up...

0.042% of customer base = $345k p/y

1% of customer base = $8.21M p/y

5% of customer base = $41M p/y

10% of customer base = $82.14M p/y

20% of customer base = $164.28M p/y

40% of customer base = $328.57M p/y

80% of customer base = $657.14M p/y

100% of customer base = $788.57M p/y

Is this math correct? Nope! It's way off. It assumes that the trading volume, along with the supply and demand of/for these NFTs will scale smoothly.

It won't. It's wonky as hell.

BUT! It does give you an idea of the benefits that NFT reward programs offer legacy brands like Starbucks 👇

The Web2 method = run a rewards program → sell more coffee.

The Web3 method = run an NFT rewards program → make recurring revenue from secondary NFT sales → sell more coffee.

Niiiice!