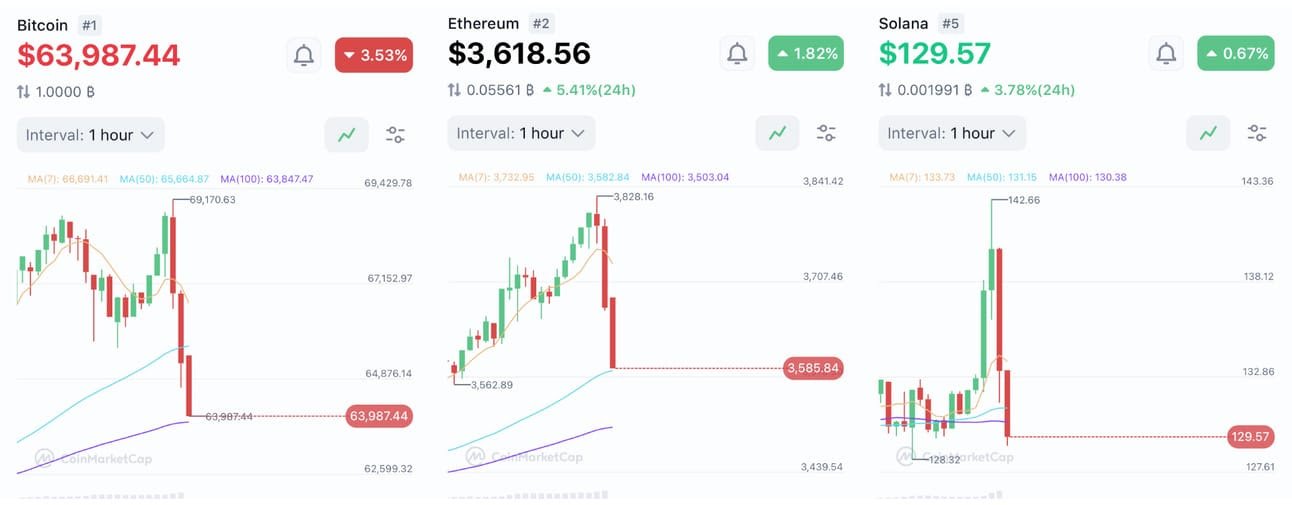

Bitcoin Hit an All Time High! Then Collapsed (Taking the Market w/ it), Here’s Why We’re Not Worried...

TL;DR

A bunch of BTC positions were sold at the ATH of $69k, resulting in a quick drop back towards $59.3k (but a correction was overdue after Feb’s wild run up).

Full Story

Bitcoin hit a new all time high of $69,093.28 (hoooray)!

Then promptly collapsed back down to $59,323.90, taking the rest of the market with it (booo)!

Here’s our left-curve attempt at ‘mid-curving’ it, with a guess at what happened:

The longs took profits, while the shorts loaded up.

(Look at us, talking the mid-curve talk).

Here’s what that means:

Longs taking profits = the folks that had been betting BTC’s price would go up decided to sell.

Shorts loading up = a whole bunch of folks took bets that the price would go down — by: borrowing BTC → selling it → and waiting/hoping to buy it back at lower prices → repay their loan and keep the difference.

“Cool cool cool. But how is it that they all decided to do so at the same time?”

Traders like to bolster their decisions, by looking for repeating chart patterns.

(I.e “BTC has done X around this price point in the past, so there’s Y% chance it’ll happen again.”)

But once BTC broke its all time high, we were in uncharted territory (with no patterns to keep traders safe n’ warm) — so, many of those with long positions would’ve sold off at $69k.

Then, knowing that this would likely be a widely held practice…

Many of those same traders would’ve set up automatic short sales to trigger at the same price point — leading to a double whammy of long/short sales which (almost immediately) tanked the price.

As to why we’re not worried?

In February, Bitcoin saw the most price appreciation in a single month in its entire history. That’s a WILDLY violent new record for a ~$1T asset to set.

At those rates, a price correction was well over due (and when it rebounds — the rest of the market will likely follow).